Let’s be real. The only thing scarier than holiday shopping malls is realizing you have three weeks left to optimize your taxes before the year closes.

For many of us living the hyphenated life, taxes aren’t just about W2s. It’s about navigating a complex web of assets here, investments back "home," and Uncle Sam wanting to know about all of it.

The Diaspora Tax Survival Guide

We aren't CPAs, and this definitely isn't financial advice, but consider this your friendly neighborhood wake-up call. Here are the things you need to look at before 2025 hits.

1. The "Silent Killer": FBAR and FATCA

If you ignore everything else, pay attention to this. The US government gets very touchy about money kept overseas that they don't know about.

The Rule of Thumb: If the combined value of all your foreign financial accounts (bank accounts, mutual funds, even that old savings account your parents opened for you when you were 10) exceeded $10,000 USD at any point during the calendar year, you almost certainly need to file an FBAR (Foreign Bank and Financial Accounts Report).

It’s separate from your tax return, and the penalties for "forgetting" are eye-watering. Just file it.

2. The Expat Alphabet Soup: FEIE vs. FTC

If you are reading this from outside the US, your year-end planning hinges on two main acronyms. You generally have to pick a lane, and switching can be tricky.

FEIE (Foreign Earned Income Exclusion): You basically get to tell the IRS, "Hey, the first $120k-ish of my salary shouldn't count because I earned it over here." Great if you are in a low-tax country.

FTC (Foreign Tax Credit): This is often better if you live in a high-tax country. You calculate your US taxes, but then subtract a dollar-for-dollar credit for the taxes you already paid to your host country.

December is the time to run the numbers with a professional to see which lane saves you more money this year.

3. Looking Ahead to 2025

The IRS just adjusted tax brackets for 2025 due to inflation. While you can't change the brackets, now is the time to look at things like maxing out retirement contributions (401k/IRA) before the year ends to lower your current taxable income.

The Bottom Line: Don't DIY this if your finances cross borders. The cost of a good cross-border accountant is usually way less than the cost of fixing a mistake with the IRS later.

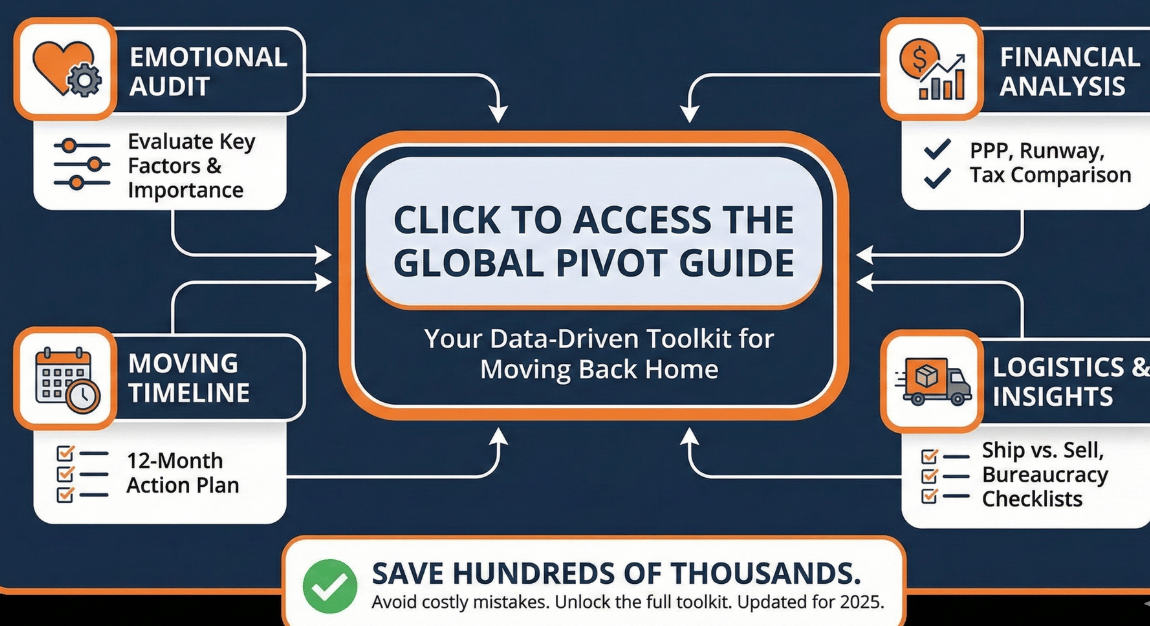

Is "I'm moving back next year" becoming your permanent personality trait? We get it. The pull of home is getting stronger, and the H1B hustle is getting harder. But turning that group chat dream into reality is overwhelming.

Stop guessing and start planning. We built the ultimate toolkit to help you decide if you're ready and help you execute if you are. ⚓️ Anchor Your Plans. Tap the link to take the quiz and unlock our exclusive Black Friday offer on concierge services. moving.theweeklychai.com.

Did that FBAR section make you sweat? 😅 We thought so. Don't gatekeep financial peace of mind, share this with your diaspora friends who need a wake-up call. For more money moves that actually make sense for our community, hit that subscribe button.